Atal Pension Yojana (APY) is a flagship pension scheme of the Government of India aimed at providing financial security after retirement. Under this scheme, individuals contribute a small amount during their working years and receive a guaranteed monthly pension after the age of 60.

APY is especially important for unorganized sector workers such as daily wage earners, laborers, drivers, shop workers, domestic helpers, and self-employed individuals who do not have access to any formal pension system. The scheme helps them build a stable and reliable source of income in old age.

Since Atal Pension Yojana is a Government-backed pension scheme, it offers assured returns with no market risk. As per the latest updates of APY 2026, the scheme continues to be active, allowing eligible citizens to enroll and secure their retirement with a fixed monthly pension.

What Is Atal Pension Yojana?

Atal Pension Yojana (APY) is a social security pension scheme launched by the Government of India to provide a fixed monthly pension to citizens after they reach the age of 60 years. The scheme is designed to encourage people to save for retirement in a disciplined and affordable manner.

Under Atal Pension Yojana, subscribers contribute a small amount every month based on their age at the time of joining and the pension amount they choose. After turning 60, they receive a guaranteed pension of ₹1,000, ₹2,000, ₹3,000, ₹4,000, or ₹5,000 per month, depending on their selected plan.

APY mainly targets individuals working in the unorganized sector who do not have access to formal retirement benefits like EPF or government pensions. Being a government-backed scheme, Atal Pension ensures assured pension benefits and long-term financial stability without exposure to market risks.

Atal Pension Yojana Benefits

Atal Pension Yojana offers several benefits that make it a reliable and affordable retirement scheme, especially for individuals working in the unorganized sector. The key benefits of APY are listed below:

- Guaranteed Monthly Pension: After attaining the age of 60 years, subscribers receive a fixed monthly pension ranging from ₹1,000 to ₹5,000, depending on the plan chosen at the time of enrollment.

- Low Monthly Contribution: The contribution amount is very affordable and depends on the subscriber’s age and selected pension amount. Starting early helps in paying a lower monthly contribution.

- Government-Backed Security: Since Atal Pension Yojana is supported by the Government of India, it is a risk-free pension scheme with assured returns.

- Spouse Pension Benefit: In case of the subscriber’s death, the spouse continues to receive the pension for life.

- Nominee Benefits: After the death of both the subscriber and spouse, the accumulated pension corpus is paid to the nominee, ensuring financial support to the family.

- Long-Term Financial Stability: APY helps individuals build a secure retirement income, reducing dependency on others in old age.

These benefits make Atal Pension one of the best long-term pension schemes for retirement planning in India.

Also Read – Latest Lado Lakshmi Yojana 2026: Big Benefits, Eligibility, New Rules & Complete Conditions

Atal Pension Yojana Eligibility Criteria

To apply for Atal Pension Yojana (APY), applicants must fulfill certain eligibility conditions set by the Government of India. These criteria ensure that the benefits of the scheme reach the intended beneficiaries.

Age Limit

- The minimum age to join Atal Pension is 18 years.

- The maximum age at the time of enrollment is 40 years.

Starting at a younger age helps in keeping the monthly contribution lower.

Who Can Apply for Atal Pension Yojana?

- The applicant must be an Indian citizen.

- A savings bank account in any authorized bank or post office is mandatory.

- The bank account should be linked with Aadhaar and an active mobile number.

- The subscriber must agree to auto-debit of the monthly contribution from the bank account.

Who Is Not Eligible?

- Individuals below 18 years or above 40 years of age at the time of application.

- Income tax payers are generally not eligible for government co-contribution benefits.

- Persons who already have an existing APY account, as only one account per individual is allowed.

Meeting these eligibility conditions is essential to enroll in Atal Pension and start building a secure retirement pension.

Atal Pension Yojana Pension Amount Details

Under Atal Pension Yojana (APY), subscribers can choose a fixed monthly pension amount that they will receive after attaining the age of 60 years. The pension amount depends on the plan selected at the time of enrollment and the contributions made during the working years.

The available monthly pension options under Atal Pension Yojana are:

- ₹1,000 per month

- ₹2,000 per month

- ₹3,000 per month

- ₹4,000 per month

- ₹5,000 per month

The monthly contribution amount varies based on the subscriber’s age at joining and the selected pension slab. Individuals who join the scheme at a younger age are required to contribute a smaller amount every month compared to those who enroll later.

Once the subscriber turns 60 years old, the chosen pension amount is paid regularly every month for life. In case of the subscriber’s death, the pension is transferred to the spouse, and after the death of both, the accumulated pension corpus is paid to the nominee.

This fixed pension structure makes Atal Pension Yojana a dependable and long-term retirement income scheme.

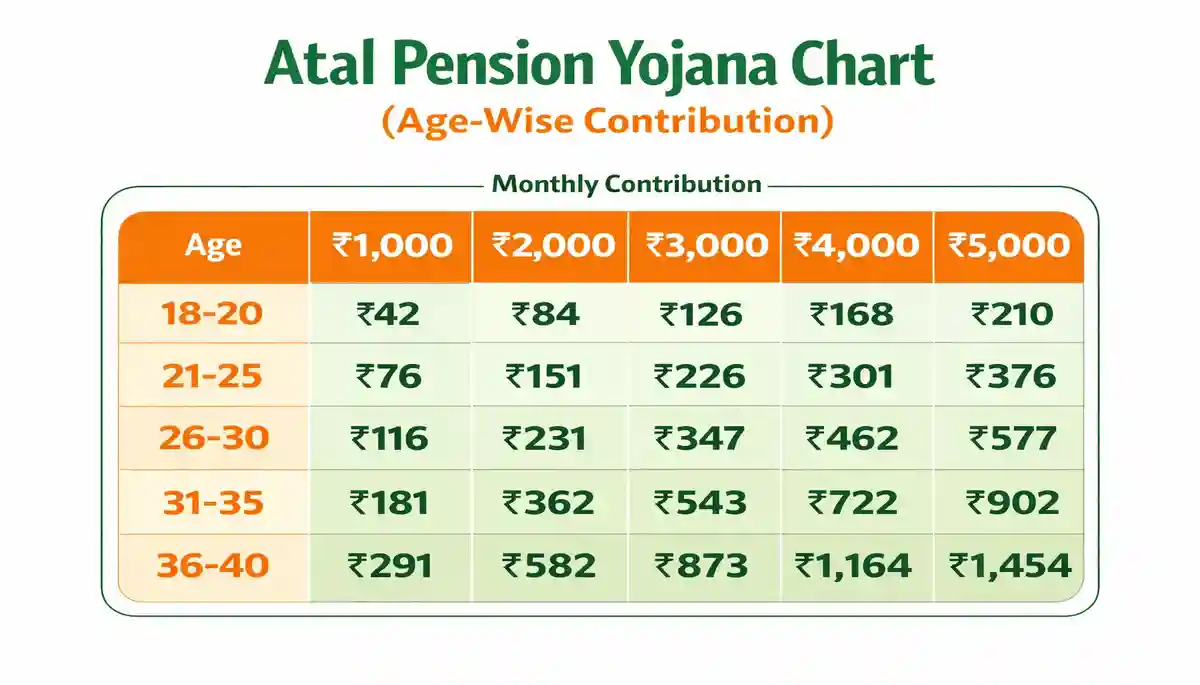

Atal Pension Yojana Chart (Age-Wise Contribution)

The Atal Pension Yojana contribution chart shows how much a subscriber needs to contribute every month based on their age at the time of joining and the pension amount selected. This chart helps applicants clearly understand their financial commitment under the scheme.

One important point to note is that the earlier you join Atal Pension Yojana, the lower your monthly contribution will be. As age increases, the required contribution amount also increases to ensure the fixed pension after 60 years.

For example:

- A person joining APY at 18 years of age needs to pay a very small monthly amount to get a pension of ₹5,000.

- A person joining at 40 years of age will have to contribute a higher amount for the same pension benefit.

The official Atal Pension Yojana chart provides age-wise and pension-wise contribution details for all pension slabs ranging from ₹1,000 to ₹5,000 per month. Applicants are advised to refer to the official APY contribution chart provided by banks or government portals for accurate and updated figures.

Using the APY chart makes it easier to choose the right pension plan according to your age and financial capacity.

Atal Pension Yojana Calculator

The Atal Pension Yojana Calculator is a useful online tool that helps applicants estimate their monthly contribution amount based on their age and selected pension plan. It allows users to plan their retirement effectively before enrolling in the scheme.

Atal Pension Yojana Calculator

By using the Atal Pension Yojana calculator, you can quickly find out how much you need to contribute every month to receive a fixed pension of ₹1,000, ₹2,000, ₹3,000, ₹4,000, or ₹5,000 after the age of 60 years.

How the APY Calculator Works

To calculate the contribution amount, you need to enter:

- Your current age

- The desired monthly pension amount

Based on these inputs, the calculator automatically shows the required monthly contribution and the total investment period until retirement.

Benefits of Using Atal Pension Yojana Calculator

- Helps in financial planning for retirement

- Shows accurate contribution details instantly

- Allows comparison between different pension options

- Saves time and avoids manual calculation errors

Using the Atal Pension Yojana calculator ensures transparency and helps you choose the most suitable pension plan according to your age and income.

Also Read – Ayushman Card Yojana 2026: Eligibility, Benefits, Apply Online & Download PDF

Documents Required for Atal Pension Yojana

To apply for Atal Pension Yojana (APY), applicants need to submit a few basic documents. Having these documents ready makes the registration process smooth and hassle-free.

The following documents are required for Atal Pension Yojana:

- Aadhaar Card – Mandatory for identity verification and linking with the APY account

- Savings Bank Account Passbook – For bank details and auto-debit of monthly contributions

- Mobile Number – Must be active and linked with Aadhaar for receiving OTPs and scheme updates

- Nominee Details – Name, relationship, and date of birth of the nominee

- Spouse Details (if applicable) – Required for pension transfer in case of the subscriber’s death

Banks may ask for additional details during the enrollment process. It is advised to ensure that Aadhaar and bank account details are correctly linked to avoid delays or rejection of the application.

Submitting the correct documents is essential to successfully register under Atal Pension Yojana and start building a secure retirement pension.

How to Apply for Atal Pension Yojana Online?

Eligible applicants can apply for Atal Pension Yojana (APY) through their bank using online or offline modes. The online process is simple and convenient, especially for those who have net banking or mobile banking access.

Online Application Process

Follow these steps to apply for Atal Pension Yojana online:

- Log in to your bank’s net banking or mobile banking portal.

- Go to the Atal Pension Yojana / Social Security Schemes section.

- Select Atal Pension Yojana (APY) from the list.

- Enter required details such as Aadhaar number, bank account details, and nominee information.

- Choose your monthly pension amount (₹1,000 to ₹5,000).

- Confirm the application and give consent for auto-debit of monthly contributions.

- Submit the form and note the acknowledgment or reference number.

After successful submission, your APY account will be activated by the bank.

Offline Application Process

Applicants who do not use internet banking can apply offline:

- Visit the nearest bank branch or post office.

- Collect and fill the Atal Pension Yojana application form.

- Submit the form along with required documents.

- Activate auto-debit facility for monthly contributions.

Once approved, contributions will be deducted automatically, and the pension benefits will start after the age of 60 years.

Atal Pension Yojana Login & Statement Check

Subscribers can easily check their Atal Pension Yojana account details, contribution status, and pension information through online and offline methods. Regularly checking the APY statement helps in tracking contributions and avoiding missed payments.

How to Login and Check APY Status

- Log in to your bank’s net banking or mobile banking app.

- Go to the Atal Pension Yojana / Social Security Schemes section.

- Select the APY account to view current status and contribution details.

Some banks also send periodic SMS alerts regarding contributions and account updates.

How to Download Atal Pension Yojana Statement

- Visit your bank branch and request an APY account statement, or

- Use net banking to download the APY statement in PDF format (if available).

The APY statement includes:

- Subscriber details

- Monthly contribution history

- Selected pension amount

- Nominee information

Checking the Atal Pension Yojana login and statement regularly ensures transparency and helps subscribers stay informed about their retirement savings.

Atal Pension Yojana Withdrawal & Exit Rules

Atal Pension Yojana (APY) has specific rules for withdrawal and exit, which subscribers should clearly understand before enrolling. These rules depend on the age of the subscriber and the reason for exit.

Exit After 60 Years

- On attaining the age of 60 years, the subscriber becomes eligible for monthly pension as per the selected plan.

- The pension amount (₹1,000 to ₹5,000) is paid for life.

- After the subscriber’s death, the spouse receives the pension.

- After the death of both subscriber and spouse, the accumulated pension corpus is paid to the nominee.

Exit Before 60 Years

- Voluntary exit before 60 years is generally allowed only in exceptional cases.

- In case of exit due to death or terminal illness, the pension benefits are transferred to the spouse or nominee as per rules.

- For other early exits, the subscriber receives the contributed amount along with applicable interest, as decided by the government.

Death of Subscriber

- If the subscriber dies before 60 years, the spouse has two options:

- Continue the APY account till 60 years, or

- Exit the scheme and receive the accumulated corpus.

These withdrawal and exit rules ensure that Atal Pension Yojana provides long-term financial security while also protecting the interests of the subscriber’s family.

Conclusion

Atal Pension Yojana 2026 is a reliable and affordable pension scheme for individuals who want a secure and guaranteed income after retirement. With low monthly contributions, fixed pension benefits, and full government backing, APY is especially beneficial for people working in the unorganized sector who do not have access to formal pension systems.

By joining Atal Pension Yojana at an early age, subscribers can reduce their contribution burden and ensure a stress-free financial life after 60 years. The scheme not only provides lifelong pension support but also safeguards the future of the subscriber’s spouse and nominee.

If you are eligible and planning for long-term financial security, Atal Pension Yojana is one of the best retirement schemes in India. Applying early and choosing the right pension amount can help you build a stable and dignified retirement.

Frequently Asked Questions (FAQs)

1. What is Atal Pension Yojana?

Atal Pension is a government-backed pension scheme that provides a guaranteed monthly pension of ₹1,000 to ₹5,000 after the age of 60 years, mainly for unorganized sector workers.

2. What is Atal Pension Yojana scheme?

Atal Pension scheme is a social security initiative of the Government of India aimed at ensuring regular income to citizens during old age through fixed pension benefits.

3. Who is eligible for Atal Pension Yojana?

Indian citizens aged 18 to 40 years with a valid savings bank account and Aadhaar-linked mobile number are eligible to apply for Atal Pension Yojana.

4. Who are not eligible for Atal Pension Yojana?

Individuals Individuals below 18 years or above 40 years of age, those with an existing APY account, and income tax payers (for government co-contribution benefits) are not eligible., those with an existing APY account, and income tax payers (for government co-contribution benefits) are not eligible.

5. How to apply for Atal Pension Yojana?

You can apply for Atal Pension through your bank’s net banking, mobile banking, or by visiting the nearest bank branch or post office.

6. How to check Atal Pension Yojana balance?

APY balance can be checked through bank net banking, mobile banking apps, or by requesting an APY statement from your bank branch.

7. How to check Atal Pension Yojana balance online?

To check APY balance online, log in to your bank’s net banking or mobile app and view the Atal Pension Yojana account details.

8. How to withdraw Atal Pension Yojana?

Withdrawal is allowed after 60 years of age in the form of monthly pension. Early exit is permitted only in specific cases like death or terminal illness.

9. How to close or cancel Atal Pension Yojana?

To close or cancel Atal Pension Yojana, you need to submit a closure request at your bank branch. Early exit rules and penalties may apply.

10. When was Atal Pension Yojana launched?

Atal Pension Yojana was launched in 2015 and continues to be active in 2026.